Before the FOMC started pushing up short-term interest rates in 2022, income investors were getting squeezed unless they entered the riskier parts of the fixed income market or turned to option-writing equity funds. One fund writing Calls against the Dow Jones Industrial Average is the Nuveen Dow 30SM Dynamic Overwrite Fund (NYSE:DIAX), which I review here. I will also review the SPDR Dow Jones Industrial Average ETF (NYSEARCA:DIA) and then compare if investors benefited from DIAX’s income-enhancing strategy. While history is only a year, the results are typical for this pairing type: more income coupled with lower return compared to the standard ETF.

Treasury yields plummeted, with the 2-year Treasury falling more than 60 basis points slipping below 4% to six-week lows as investors bet that the turmoil in the banking sector may force the Fed to rethink its rate hike path.

“Fed funds futures are reducing pricing for the size of a potential hike at that meeting to be closer to 25bps,” Scotia Economics said in a note. Before the turmoil in the banking sector began to unfold over the back half of last week the market had been pricing most of a 50bps move, Scotia Economics added.

Goldman Sachs, meanwhile, believes the Fed isn’t likely to hike at all in March, citing the stresses in the banking system. The odds of the Fed pausing hikes at its meeting next week jumped to 47%, according to Investing.com’s Fed Rate Monitor Tool.

Following the collapse of Silicon Valley Bank and Signature Bank (NASDAQ:SBNY), the U.S. government and Federal Reserve stepped to rescue the beleaguered banks, agreeing to backstop all depositors.

The Fed also launched a new funding program offering loans with maturities of up to year.

The support from the Fed failed to stem the turmoil in banks, however, with First Republic Bank (NYSE:FRC) falling more than 60%, while shares of major banks including JPMorgan Chase & Co (NYSE:JPM), BAC, and Citigroup (NYSE:C) (NYSE:C) also down sharply.

Tech stocks, however, helped the broader market recovery underpinned by the fall in Treasury yields.

Microsoft (NASDAQ:MSFT) was up 2%, Apple (NASDAQ:AAPL) up more than 1% following by Meta Platforms (NASDAQ:META) and Google-parent Alphabet (NASDAQ:GOOGL).

In other news, Roku (NASDAQ:ROKU) closed lower after the company said Friday it revealed it had about $487 million, or 26%, of its cash reserves stuck at Silicon Valley Bank.

Looking toward Tuesday’s Asia-Pacific trading session, volatility remains a key risk for regional indices. There is a chance that markets will continue to focus on the Fed pivot. That may end up boosting stocks in certain sectors. But, keep in mind that in less than 24 hours, the next US inflation report crosses the wires. Another sticky print could further elevate market uncertainty.

Dow Jones Technical Analysis

The Dow Jones appears to be trading within the boundaries of a Descending Channel since the end of December. Prices recently tested the floor as well as the key 31738 – 32017 support zone. From here, a bounce would place the focus on the 50-day Simple Moving Average (SMA). Otherwise, breaking lower opens the door to extending the near-term downtrend.

Shares tumbled 32% in after-hours trading after the open source software firm issued weaker-than-expected first quarter and full-year revenue guidance.

On Monday, the Dow Jones Industrial Average fell after a plan to backstop depositors in Silicon Valley Bank failed to buoy bank stocks, as well as the S&P 500. The Dow lost 90.50 points, or 0.28%, while the broad-market index lost 0.15%.

On the other hand, the tech-heavy Nasdaq Composite bucked the trend, rising 0.45%, as some investors bet the collapse at Silicon Valley Bank could mean a pause in future interest rate hikes from the Federal Reserve.

“What we’ve seen in the last week, is the first shot across the bow in terms of the effect of tightening,” Evercore ISI’s Julian Emanuel said Monday on CNBC’s “Fast Money.”

“We are going to have a recession … we do think it’s likely to be mild, and so therefore what we’re thinking is you’re going to get a retest of those October lows, but eventually get that buying opportunity that we’ve been waiting for for almost two years now. That will launch the next bull market phase,” Emanuel said.

Investors are hotly anticipating the latest inflation data. Due out Tuesday before the bell, the February consumer price index is expected to show a rise of 0.4% last month, according to consensus estimates from Dow Jones. That’s down from a 0.5% increase the prior month.

OVERVIEW

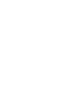

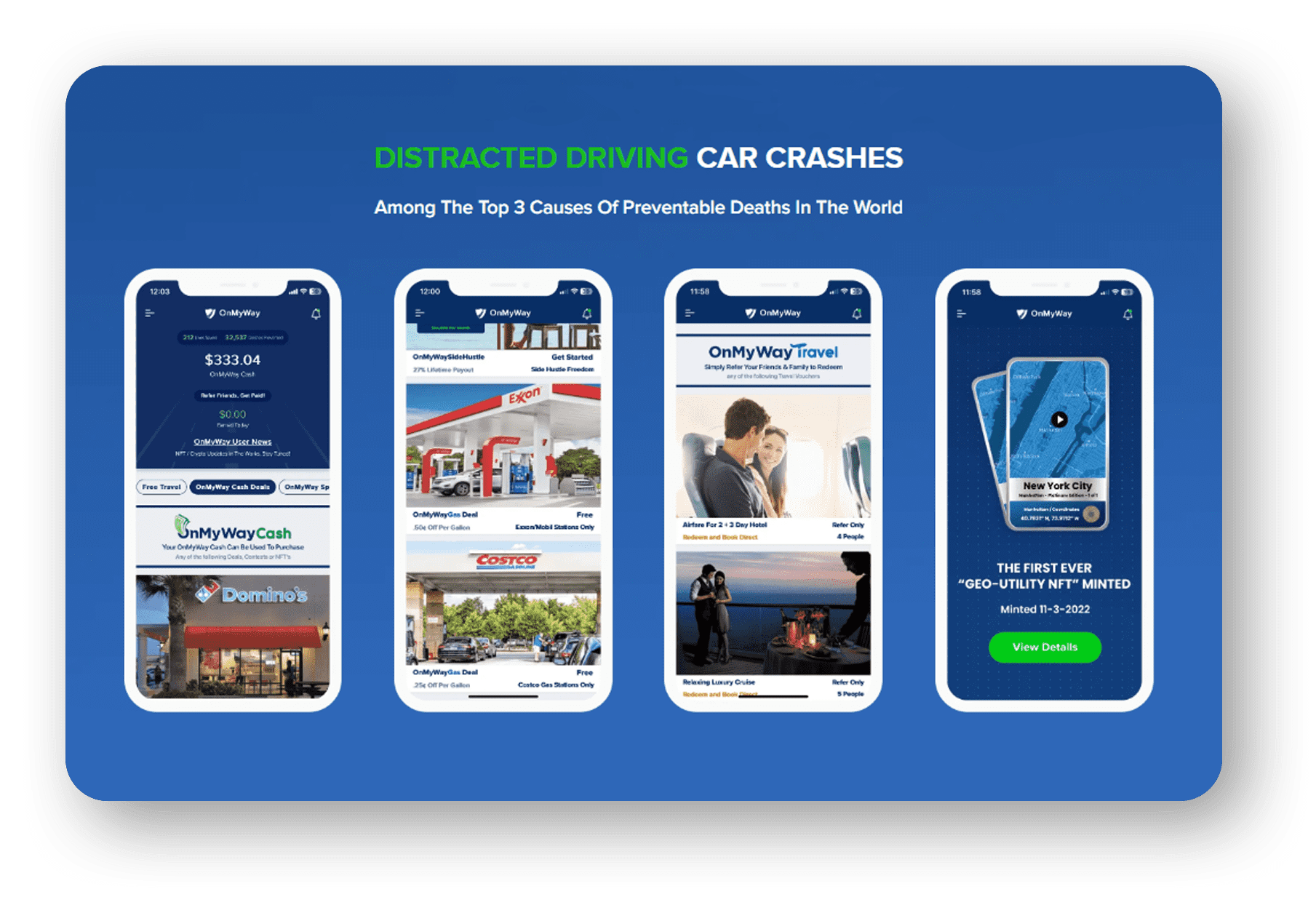

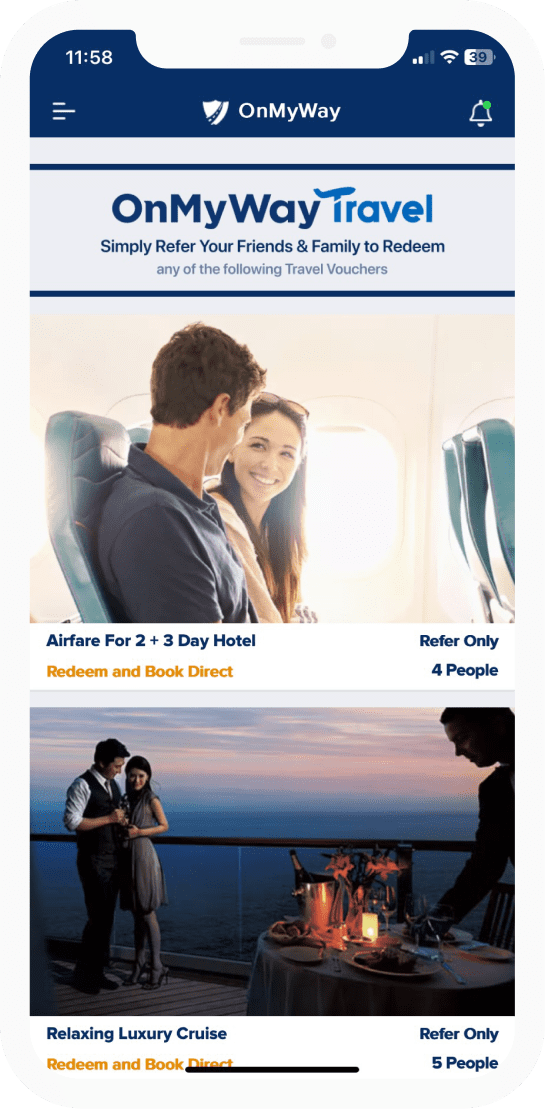

OnMyWay Is The #1 Distracted Driving Mobile App In The Nation!

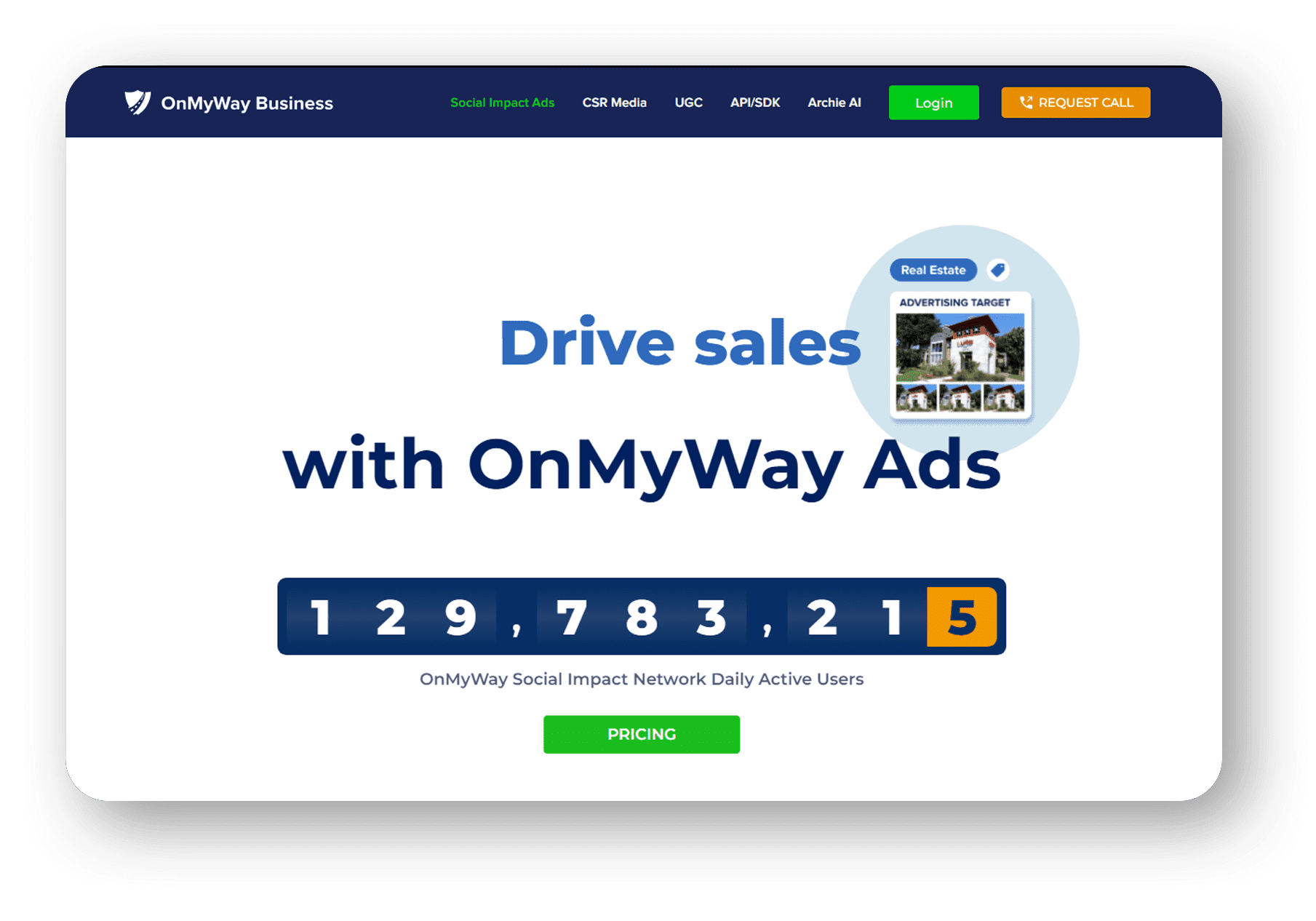

OnMyWay, based in Charleston, SC, The Only Mobile App That Pays its Users Not to Text and Drive.

The #1 cause of death among young adults ages 16-27 is Car Accidents, with the majority related to Distracted Driving.

OnMyWay’s mission is to reverse this epidemic through positive rewards. Users get paid for every mile they do not text and drive and can refer their friends to get compensated for them as well.

The money earned can then be used for Cash Cards, Gift Cards, Travel Deals and Much, Much More….

The company also makes it a point to let users know that OnMyWay does NOT sell users data and only tracks them for purposes of providing a better experience while using the app.

The OnMyWay app is free to download and is currently available on both the App Store for iPhones and Google Play for Android @ OnMyWay; Drive Safe, Get Paid.

Download App Now – https://r.onmyway.com

Sponsors and advertisers can contact the company directly through their website @ www.onmyway.com