It’s the 11th rate increase since the Fed began its inflation fight in March 2022, and comes just one month after the central bank hit pause in order to assess the state of the economy after the failures of three regional banks since the spring.

Fed officials are estimating one more rate hike this year, according to their latest set of projections. Inflation’s steady slowdown in recent months has been encouraging for American consumers and businesses, but officials reiterated in their post-meeting statement that “inflation remains elevated” and that the Fed “remains highly attentive to inflation risks,” suggesting that another rate hike remains on the table.

In a news conference following the decision, Fed Chair Jerome Powell underscored that another rate hike remains an option — if the economy were to pick up strength and keep upward pressure on prices.

“At the margins, stronger growth could lead over time to higher inflation and that would require an appropriate response for monetary policy,” Powell said. He also said that core inflation remains “pretty elevated.”

Stocks closed on a mixed note after Powell’s speech, but the Dow notched its 13th straight day of gains, its longest daily win streak since 1987. The S&P 500 closed flat and the Nasdaq Composite dipped slightly.

Inflation is still the No. 1 focus

The Fed’s preferred inflation gauge — the Personal Consumption Expenditures price index — rose 3.8% in May from a year earlier, down from the prior month’s 4.3%. Meanwhile, the core measure inched down to 4.6% from 4.7% during the same period, which was still its lowest level since October 2021. The Commerce Department releases June figures on Friday.

Officials want to retain the option of another rate hike in case inflation proves to be more resilient than expected, but the timing of that final hike is still a question mark. It’s possible that a second hike never comes and the Fed decides to move on to the next phase of its inflation fight, which would be to hold rates steady until inflation is defeated. Powell said officials haven’t decided to consider hikes at every other meeting, and that future decisions will hinge on data.

“We’ll be asking ourselves does this whole collection of data — do we assess it as suggesting that we need to raise rates further? And if we make that conclusion then we will go ahead and raise rates, so that’s how we’re thinking about the next meeting and how we’re thinking about these going forward,” Powell said.

The central bank head’s remarks at the Jackson Hole annual economics symposium next month could shed more light on what to expect at the Fed’s monetary policy meeting in September.

Still, investors are bullish about the end of rate hikes and the Fed’s chances of pulling off a soft landing, a scenario in which inflation slides to the 2% target without the economy sharply deteriorating. But Powell said Wednesday “we have to be honest about the historical record, which does suggest that when central banks go in and slow the economy to bring down inflation, the results tend to be some softening labor conditions — and so that is still the likely outcome here.”

The labor market remains robust

The Fed is highly attentive to the state of the job market, and whether it is coming into better balance. There are some signs that it has. Job openings are down from their peak last year, the rate of quitting has slowed to near pre-pandemic levels, and the share of prime-age workers (those between ages 25 and 54) is at its highest level since 2002.

Inflation has cooled without a sharp uptick in the unemployment rate, but it remains to be seen whether that could continue. Research suggests the Fed has no choice but to slow the economy further because of the tight labor market’s persistent role in pushing up consumer prices, which could result in an economic slump.

“The tightness in the labor market clearly has the Federal Reserve feeling uneasy. Even with another rate hike, I’m not sure we’ll see the underlying conditions moderate in the near future,” wrote Chris Todd, chief executive officer of payroll software provider UKG. “There are fewer job openings, and fewer people are voluntarily leaving their job for new employment compared to the last few years, but we’ve yet to see the loosening that the Fed is searching for.”

Powell said the Fed wants to see a “broad cooling” of the labor market, which includes wage growth slowing to pre-pandemic levels.

The importance of wage growth

Officials are closely watching wage growth figures because of the role that labor costs play in pushing up prices. Higher labor costs loom large for labor-intensive services businesses such as restaurants and hospitals, and the Fed’s remedy to that is to take some demand out of the economy through rate hikes. It could take at least a year for the effect of rate hikes to filter through to the broader, real economy, according to some research, and it’s already been more than a year since the Fed began lifting rates.

The Labor Department releases its Employment Cost Index for the second quarter Friday, and the index for the first quarter showed that pay gains picked up.

There will be two jobs reports released before the Fed’s September meeting, and while there isn’t any numeric threshold the Fed has in mind for labor market conditions, the economy must typically add between 70,000 to 100,000 jobs a month to keep up with job growth. Employers added 209,000 jobs in June, gains that are a little too robust for the Fed.

The Commerce Department releases its first estimate of second-quarter gross domestic product Thursday, and it’s expected to show that economic growth mostly held up as consumer spending slowed sharply.

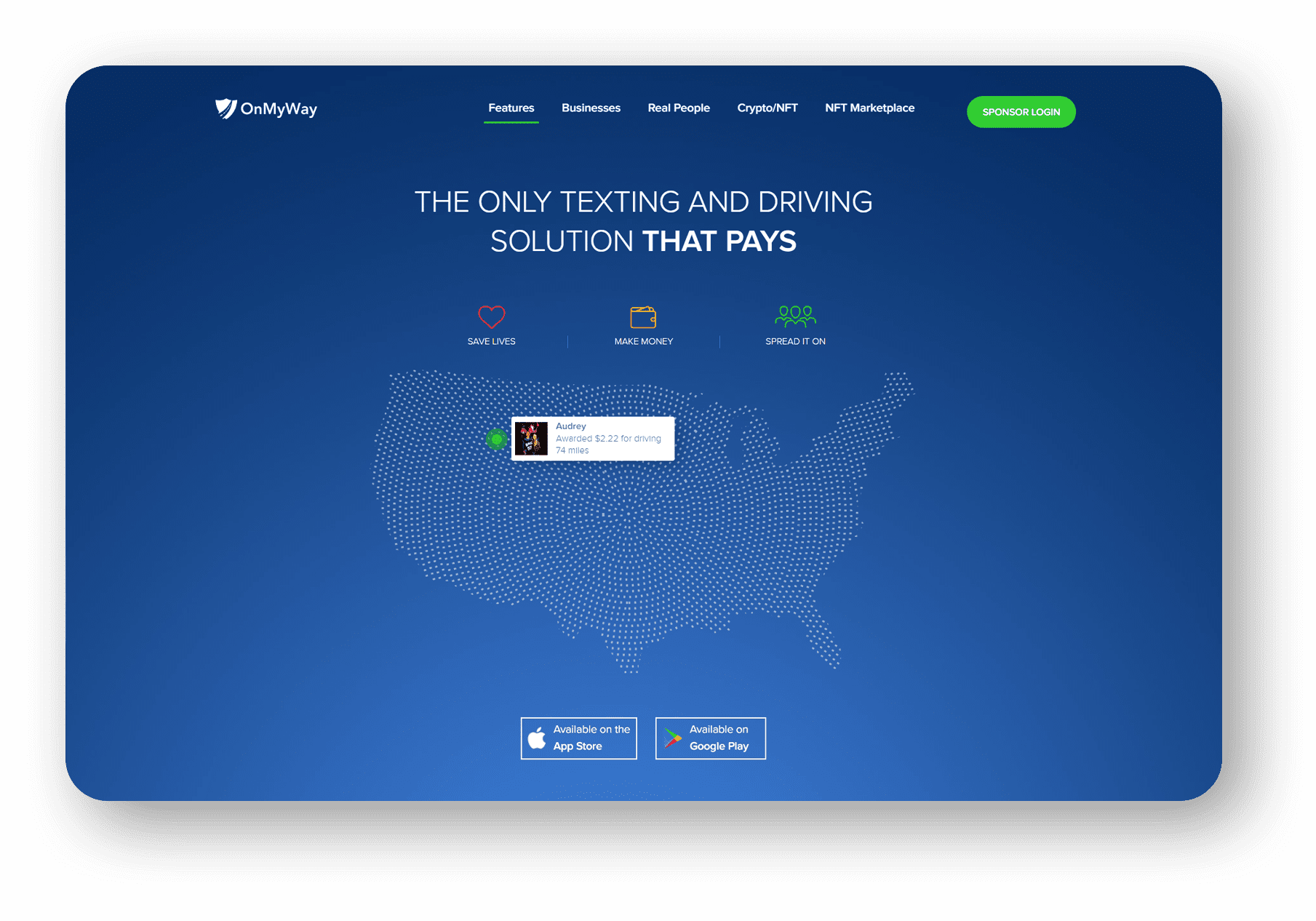

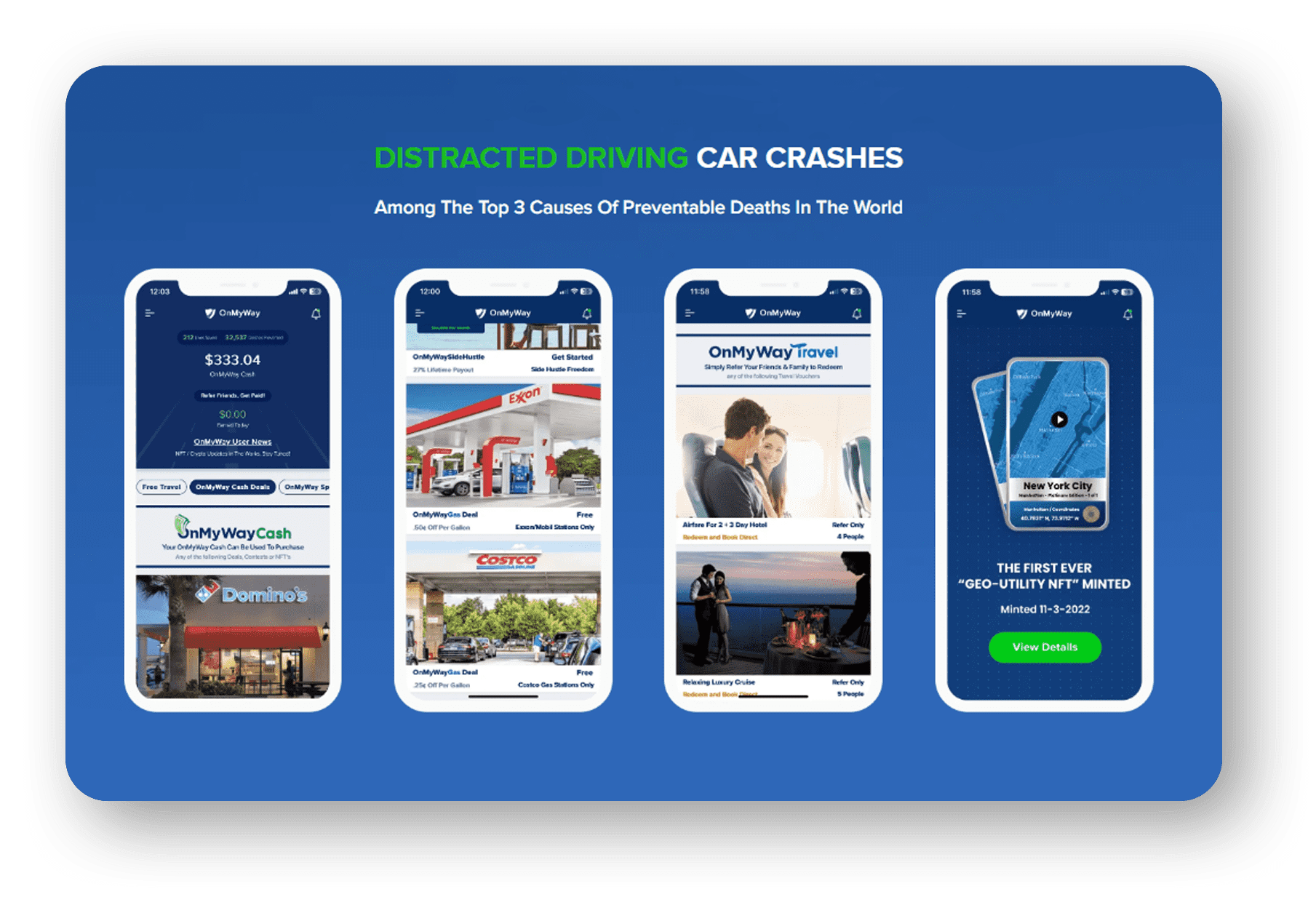

OVERVIEW

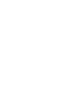

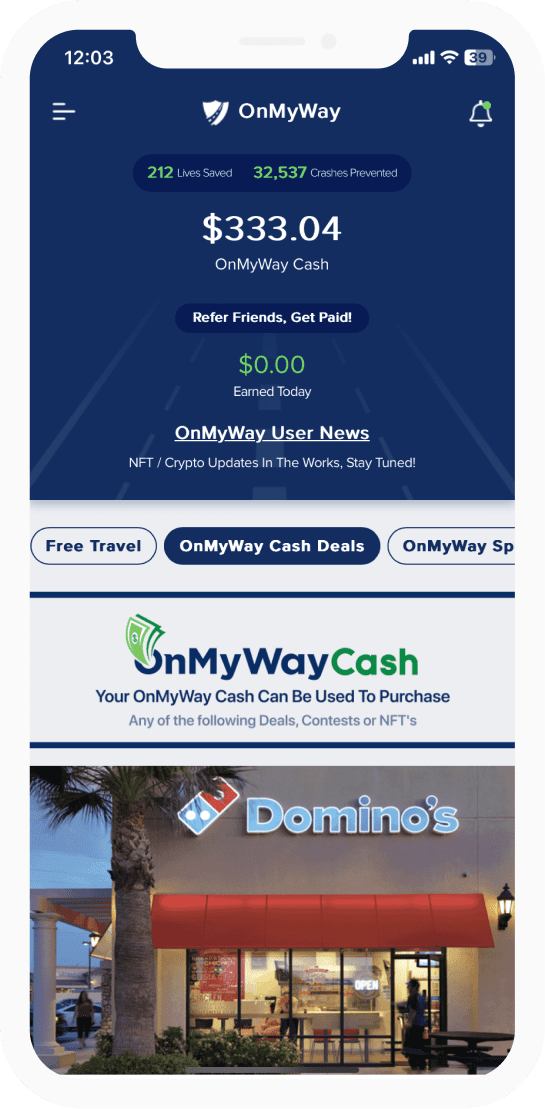

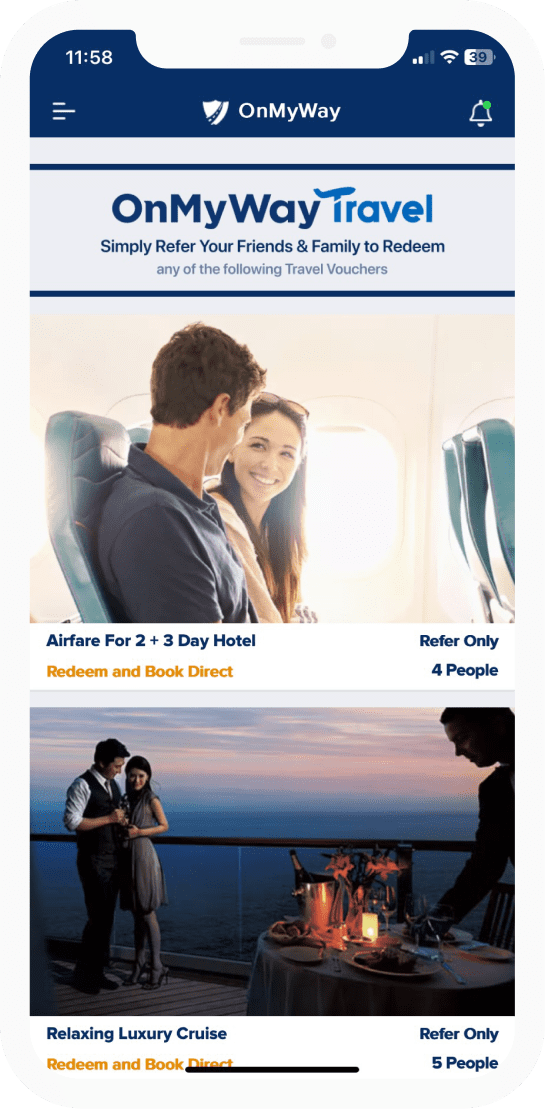

OnMyWay Is The #1 Distracted Driving Mobile App In The Nation!

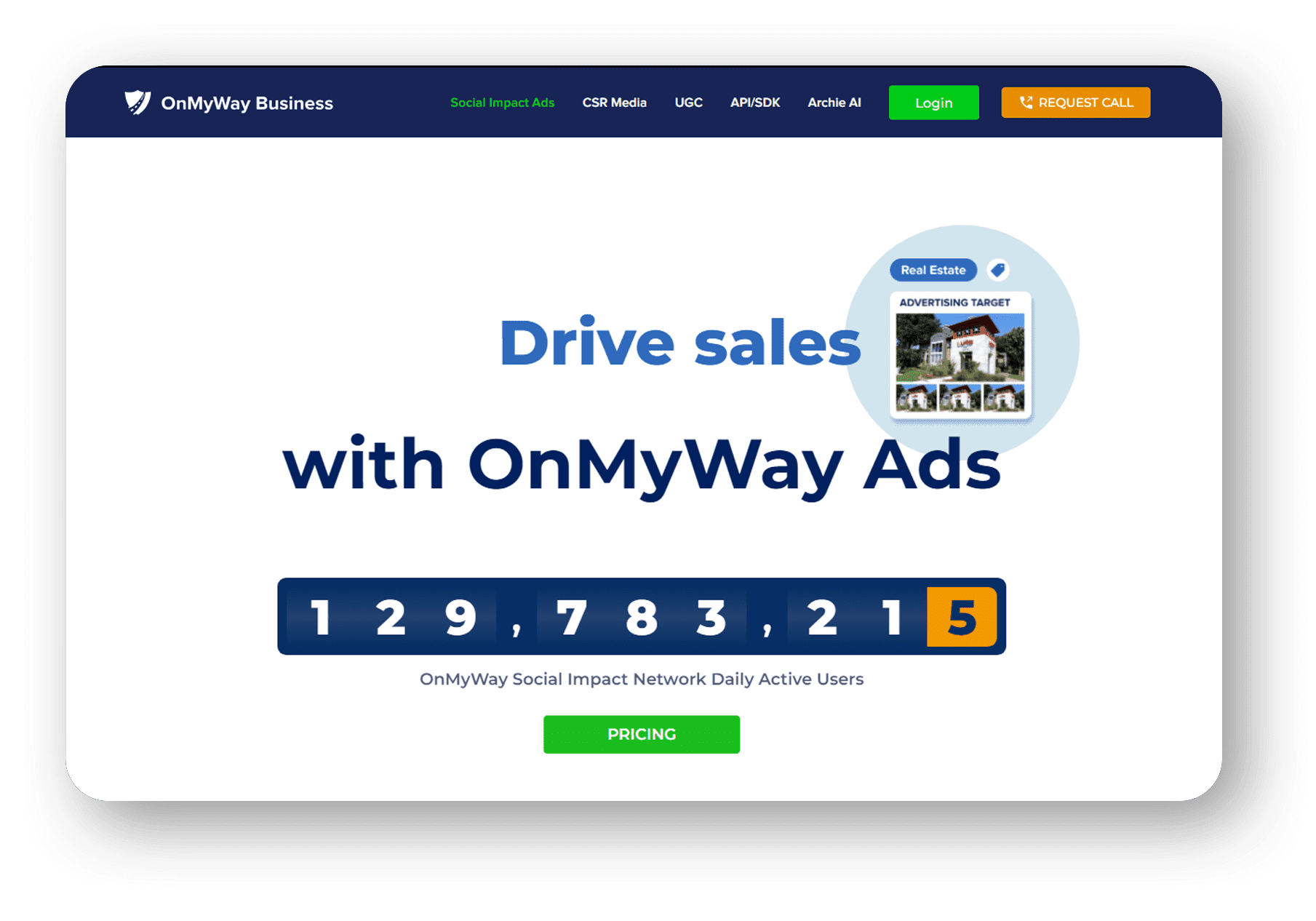

OnMyWay, based in Charleston, SC, The Only Mobile App That Pays its Users Not to Text and Drive.

The #1 cause of death among young adults ages 16-27 is Car Accidents, with the majority related to Distracted Driving.

OnMyWay’s mission is to reverse this epidemic through positive rewards. Users get paid for every mile they do not text and drive and can refer their friends to get compensated for them as well.

The money earned can then be used for Cash Cards, Gift Cards, Travel Deals and Much, Much More….

The company also makes it a point to let users know that OnMyWay does NOT sell users data and only tracks them for purposes of providing a better experience while using the app.

The OnMyWay app is free to download and is currently available on both the App Store for iPhones and Google Play for Android @ OnMyWay; Drive Safe, Get Paid.

Download App Now – https://r.onmyway.com

Sponsors and advertisers can contact the company directly through their website @ www.onmyway.com