Argentina’s rising central bank debt poses a risk to the country’s monetary stability, ratings agency Moody’s said on Wednesday, adding it could further stoke inflation and aggravate any exchange rate shock if savers flee from the local peso currency.

In that scenario, Moody’s warned, authorities could even freeze peso deposits, an extreme measure which would bring back memories of the infamous “corralito” restrictions during the 2001 crisis that aimed to prevent a run on the banks.

“With the amount of pesos the central bank and government have, they may conclude that they have no choice but to limit access,” Moody’s analyst Gabriel Torres said in a webinar.

“Argentina has not been in that situation for a while, but it has done so in the past,” he added.

In a report Moody’s said central bank interest-bearing debt had increased significantly relative to GDP in the last two years, while its ratio to the monetary base was now over 200%.

“The ratio to the monetary base is comparable to the one observed in the late 1980s, a period that included a hyperinflationary episode,” it added.

The entity said that there were refinancing risks related to local currency debt, with 64% of it maturing in less than a year and 70% of it indexed to inflation, which is currently running at 88% annually and expected to hit 100% this year.

“Because inflation is in the order of 100%, a sudden exchange rate shock could lead authorities to consider freezing peso-denominated bank deposit and savings accounts to limit further pressures on the exchange rate,” the report said.

“Argentinean banks’ exposure to government and central bank debt – mostly denominated in local currency – has recently increased and poses systemic risks for the financial sector.”

Later Wednesday, ratings agency S&P lowered Argentina’s local currency rate to CCC- from CCC+, with a negative outlook, adding that policy disagreements within Argentina’s government and opposition “are weighing on financing conditions in local markets.”

“Macroeconomic instability and a polarized political landscape are exacerbating vulnerabilities for local debt placements, especially given the magnitude of maturing debt as the 2023 primary (PASO) and national elections near,” it added.

OVERVIEW

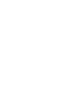

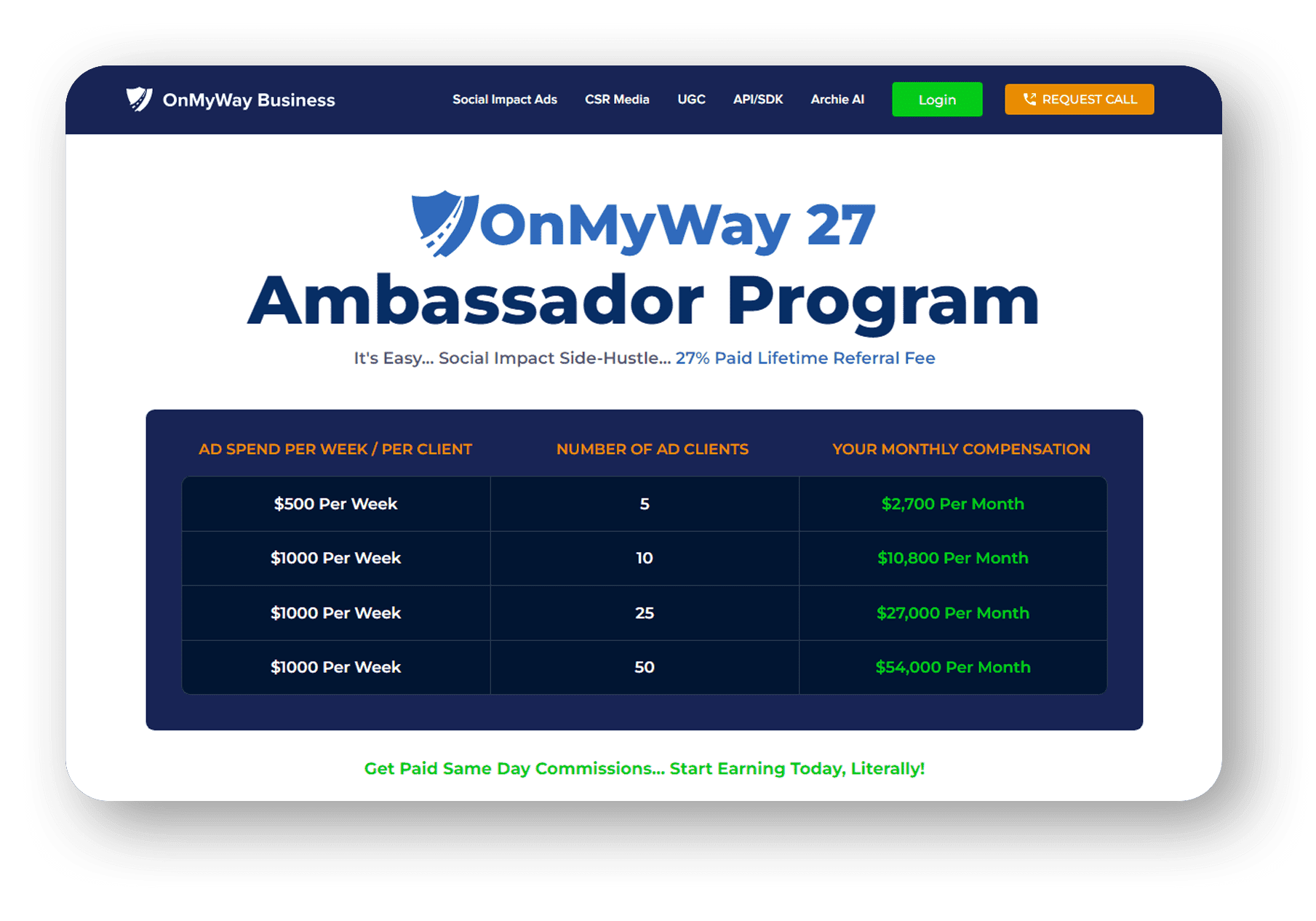

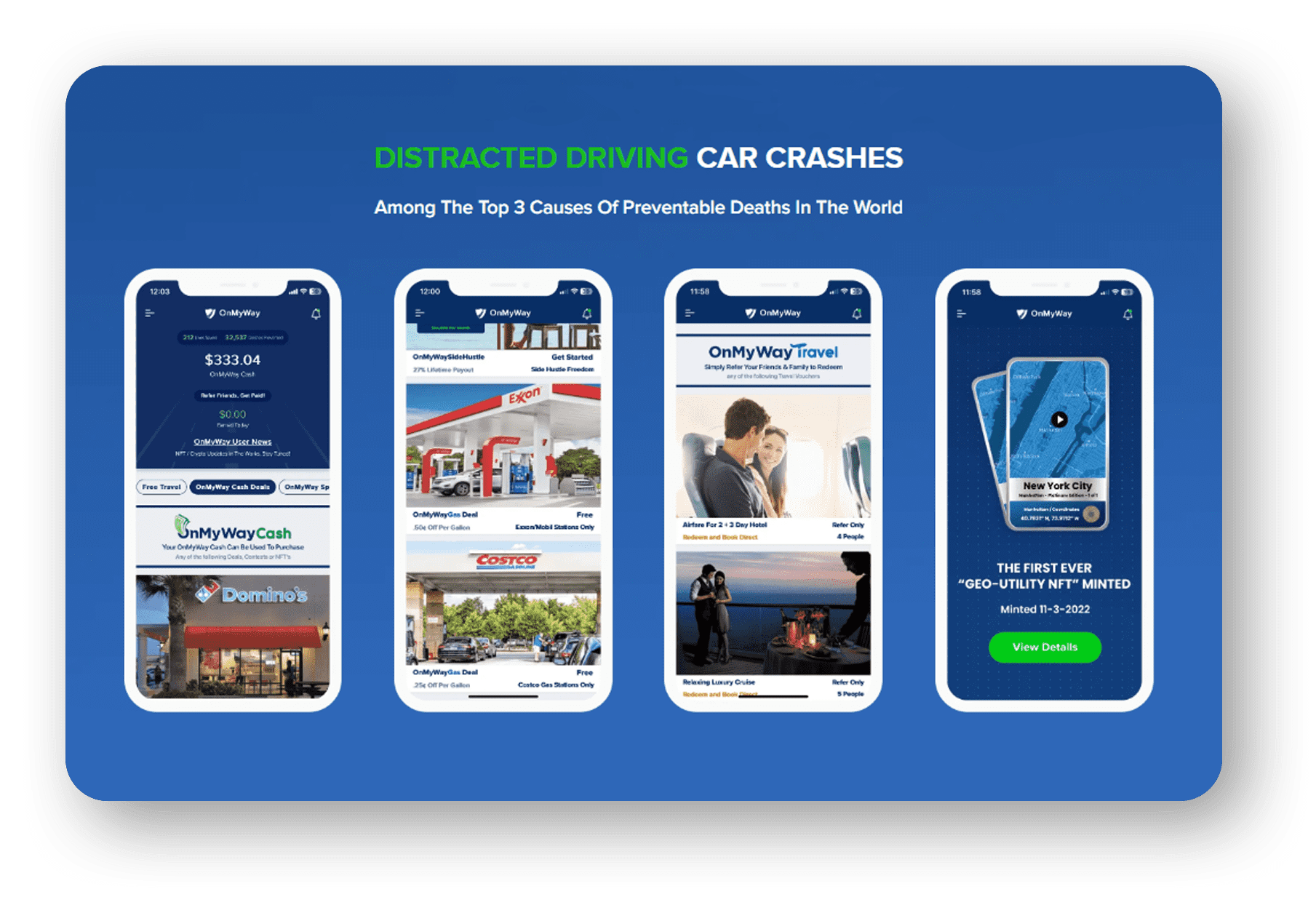

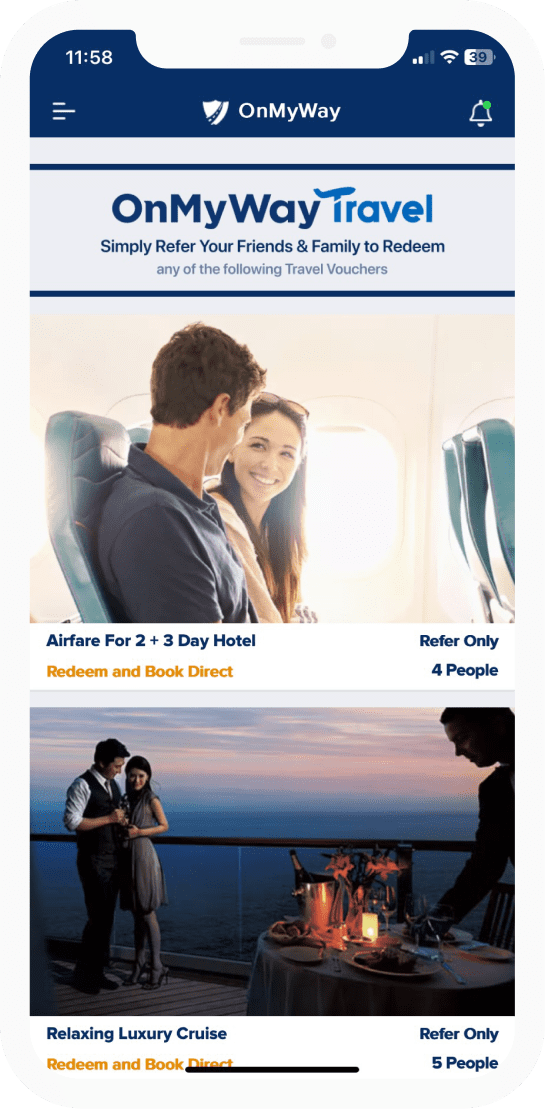

OnMyWay Is The #1 Distracted Driving Mobile App In The Nation!

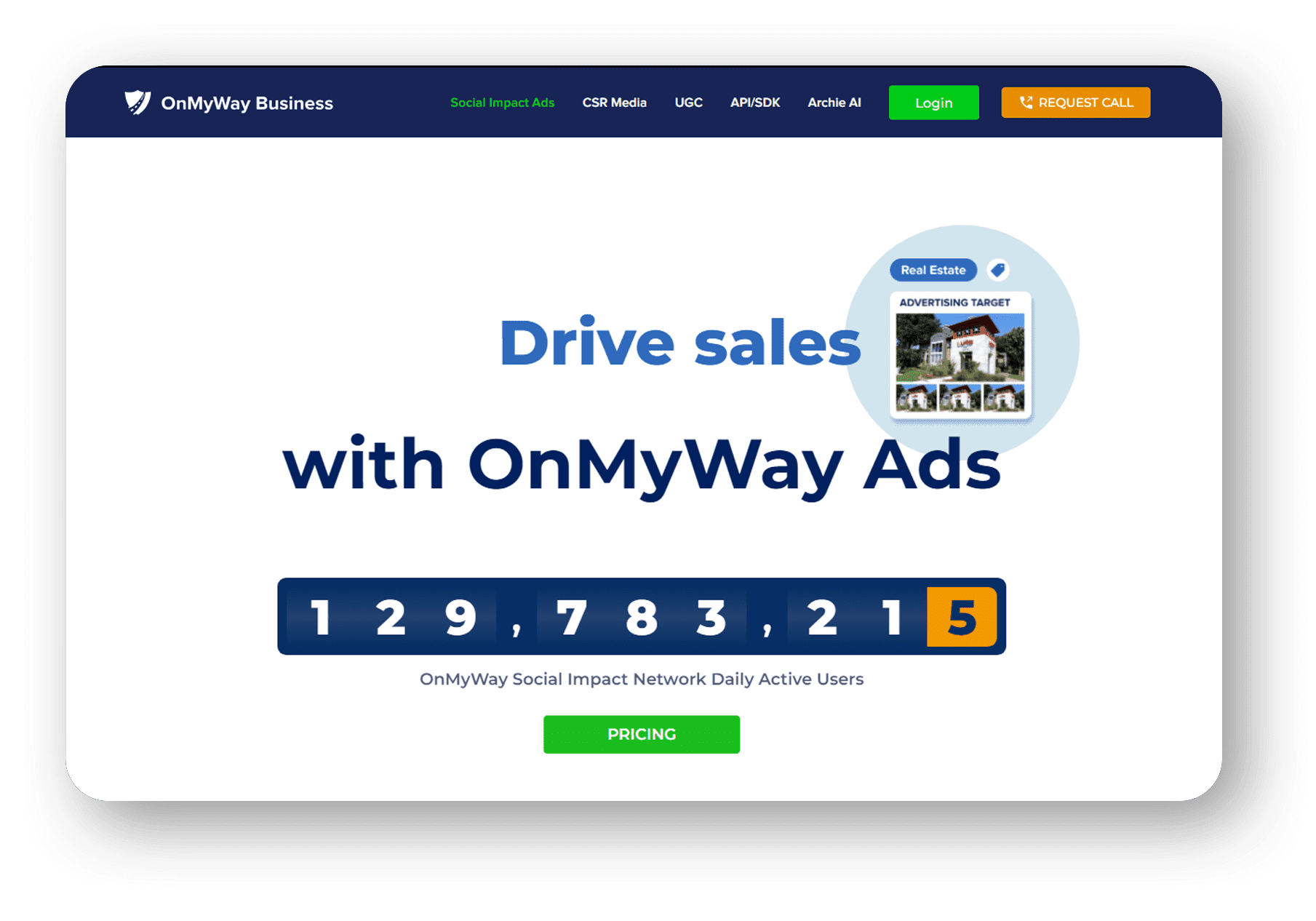

OnMyWay, based in Charleston, SC, The Only Mobile App That Pays its Users Not to Text and Drive.

The #1 cause of death among young adults ages 16-27 is Car Accidents, with the majority related to Distracted Driving.

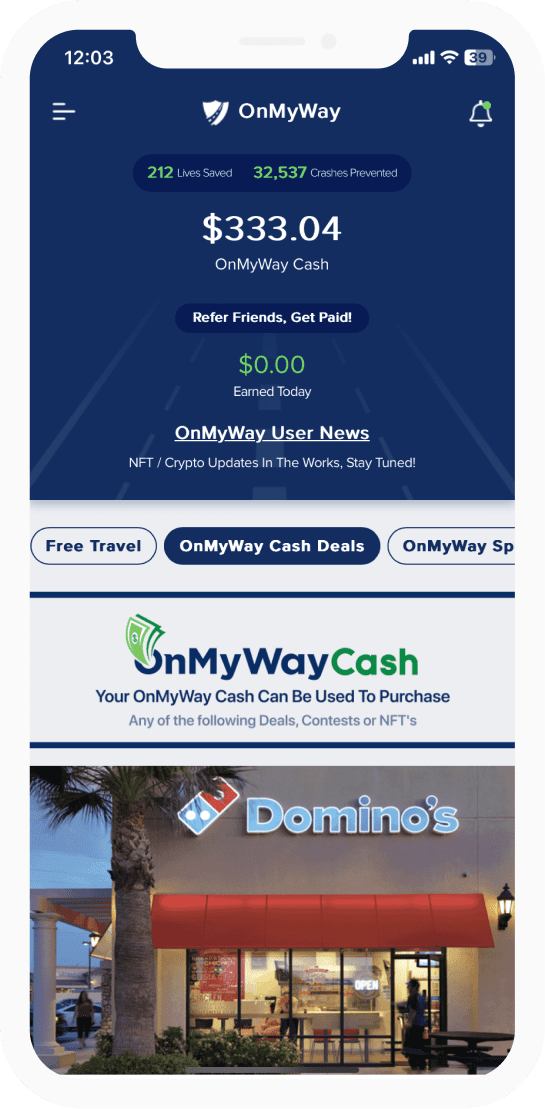

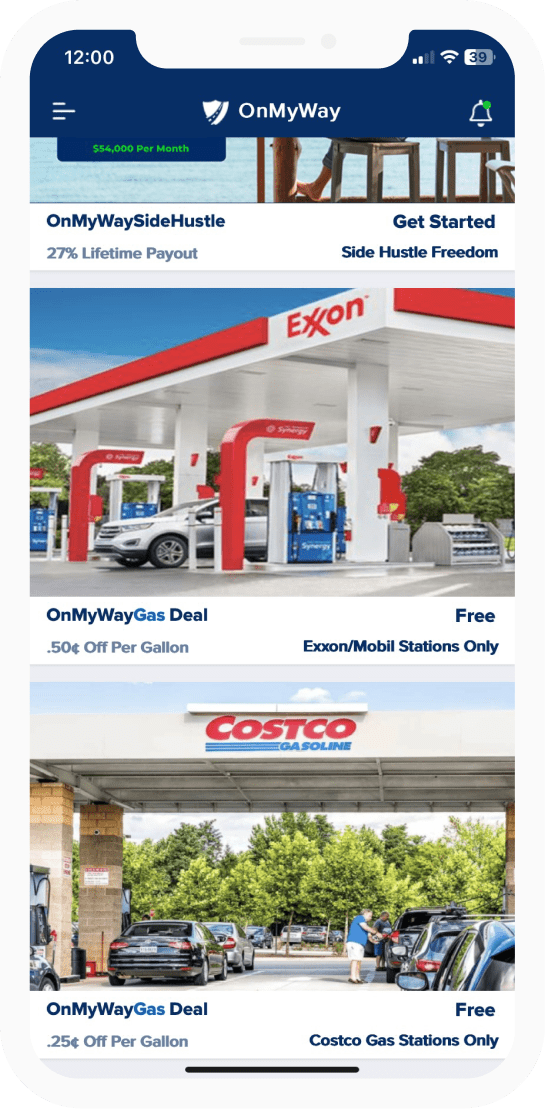

OnMyWay’s mission is to reverse this epidemic through positive rewards. Users get paid for every mile they do not text and drive and can refer their friends to get compensated for them as well.

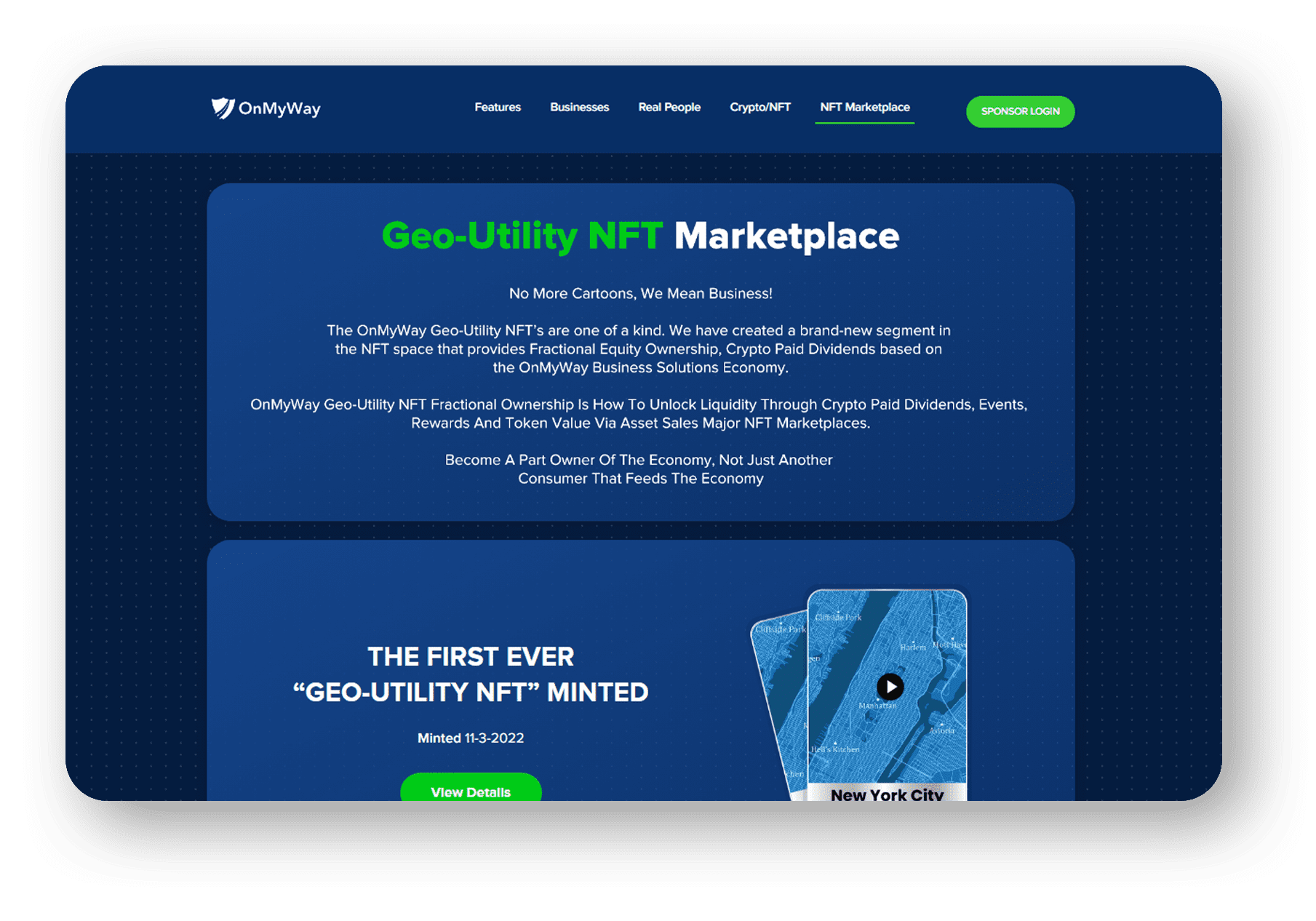

The money earned can then be used for Cash Cards, Gift Cards, Travel Deals and Much, Much More….

The company also makes it a point to let users know that OnMyWay does NOT sell users data and only tracks them for purposes of providing a better experience while using the app.

The OnMyWay app is free to download and is currently available on both the App Store for iPhones and Google Play for Android @ OnMyWay; Drive Safe, Get Paid.

Download App Now – https://r.onmyway.com

Sponsors and advertisers can contact the company directly through their website @ www.onmyway.com