China’s digital yuan took the centre stage in the world’s largest cross-border central bank digital currency (CBDC) trial to date, a report showed, pointing to how Beijing is speeding up yuan globalization efforts amid rising geopolitical tensions.

China’s digital currency, or e-CNY, was the most issued, and actively transacted token in the $22 million pilot that used CBDCs to settle cross-border trades, a Bank of International Settlement (BIS) report showed.

The six-week test, which ended late last month, is part of m-Bridge – a project that pilots cross-border payments in digital currencies issued by central banks of China, Hong Kong, Thailand and United Arab Emirates.

The successful completion of the large-scale testing comes amid rising global tensions.

“Many countries around the world, including China, are wary of US financial sanctions,” said G. Bin Zhao, senior economist at PwC China.

“This provides a historic window for China to promote yuan internationalization as the US weaponizes the dollar,” he said, adding that the e-CNY provides a shortcut.

Russia was kicked out of the dollar system by the West following its February invasion of Ukraine which Moscow has called “special operations.” During the just-ended Communist Party Congress, Chinese President Xi Jinping pledged “reunification” with Taiwan, saying China does not “renounce the use of force”.

Washington has warned Beijing that the sanctions it coordinated against Russia should serve as a warning as to what to expect should Beijing move against self-ruled Taiwan.

“The perceived threat from the US … has made RMB globalization more of a necessity than luxury to ensure economic and financial security,” said Shuang Ding, chief economist, Greater China and North Asia at Standard Chartered (HK) Ltd.

A yuan internationalization tracker complied by Standard Chartered hit a new high in July, driven by strong issuance of yuan-denominated bonds in Hong Kong, latest data shows.

To promote global use of the yuan, the PBOC in July upgraded a currency swap facility with Hong Kong to a permanent agreement, and in September, China agreed to set up a yuan clearing hub in Kazakhstan.

In Russia, use of the yuan in global payments has surged since the western sanctions, and a growing number of Russian companies, including Rosneft, Rusal, and Polyus, have issued yuan bonds.

GLOBAL AMBITION

China is at the fore of a global race to develop CBDCs, and is ramping up domestic pilot schemes, mainly for retail payments. The PBOC’s participation in m-Bridge represents its ambition to eventually promote global, wholesale use of the e-CNY.

A total of 11.8 million yuan ($1.64 million) worth of e-CNY was issued in the testing between Aug 15. and Sept. 23, and the Chinese currency was used in a total of 72 payment and foreign exchange transactions, far greater than the other three currencies each.

HEADWINDS

The m-Bridge project, launched jointly by the BIS innovation hub and the four participating central banks, aims eventually to build a common platform for efficient, low-cost digital payment to promote global trade.

But China’s yuan inter-nationalization, digital or not, faces challenges amid a slowing economy ravaged by Covid flare-ups, and a property debt crisis.

“Whether it’s the e-CNY or the yuan, at the end of the day, China’s national strength is the decisive factor,” PwC’s Zhao said.

“The yuan or e-CNY would be widely accepted only with the endorsement of China’s solid economic development.”

Another headwind is a slumping yuan, which has lost roughly 12% against the US dollar this year.

“Sustained depreciation due to worsening fundamentals could weaken confidence in the currency,” Standard Chartered’s Ding said.

The yuan’s share as a global payments currency has climbed for five straight months, but remains low, standing at 2.44% in September, compared with 42.3% for the US dollar, and 35.2% for the euro, according to SWIFT, the global financial messaging system.

OVERVIEW

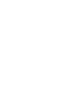

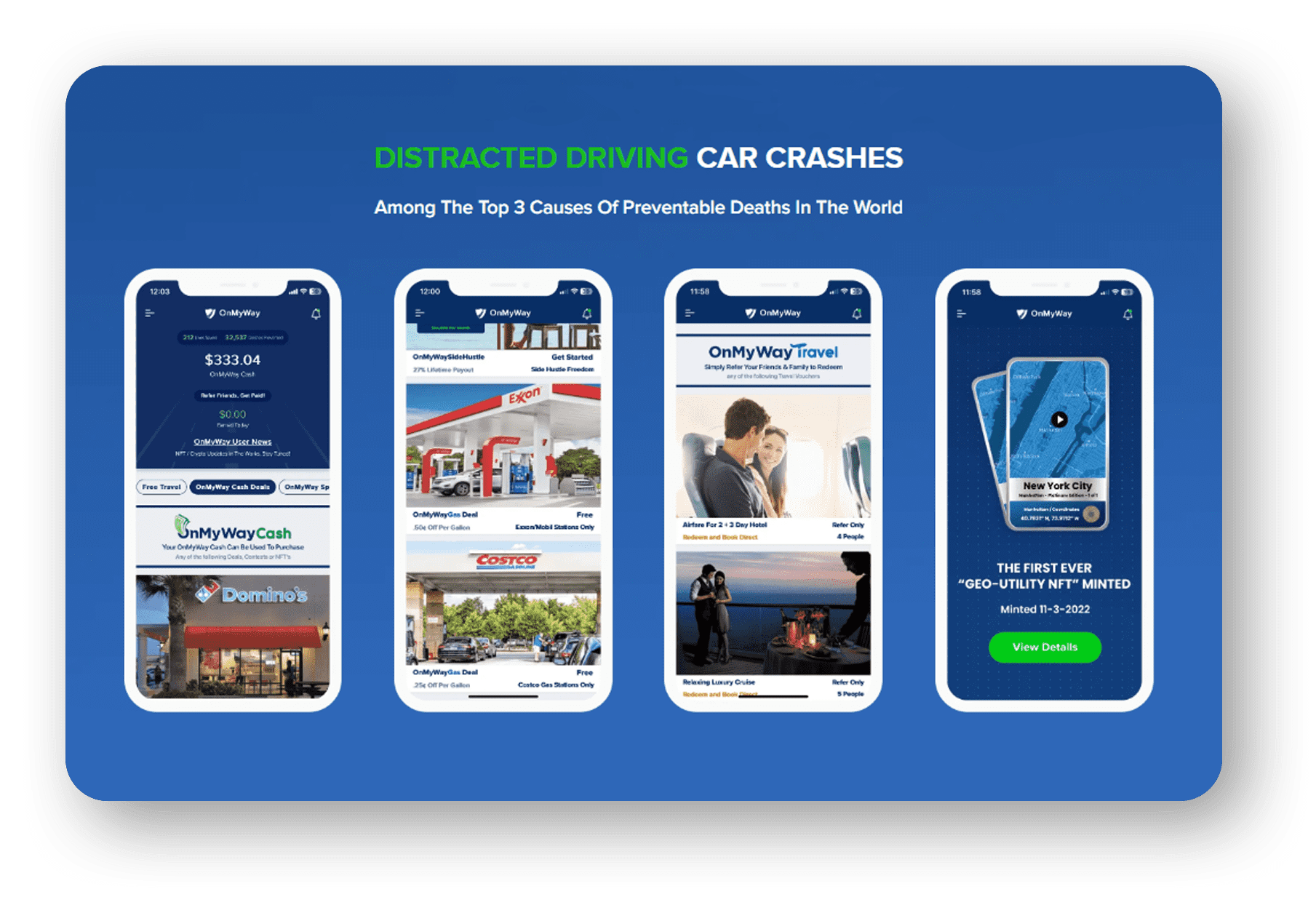

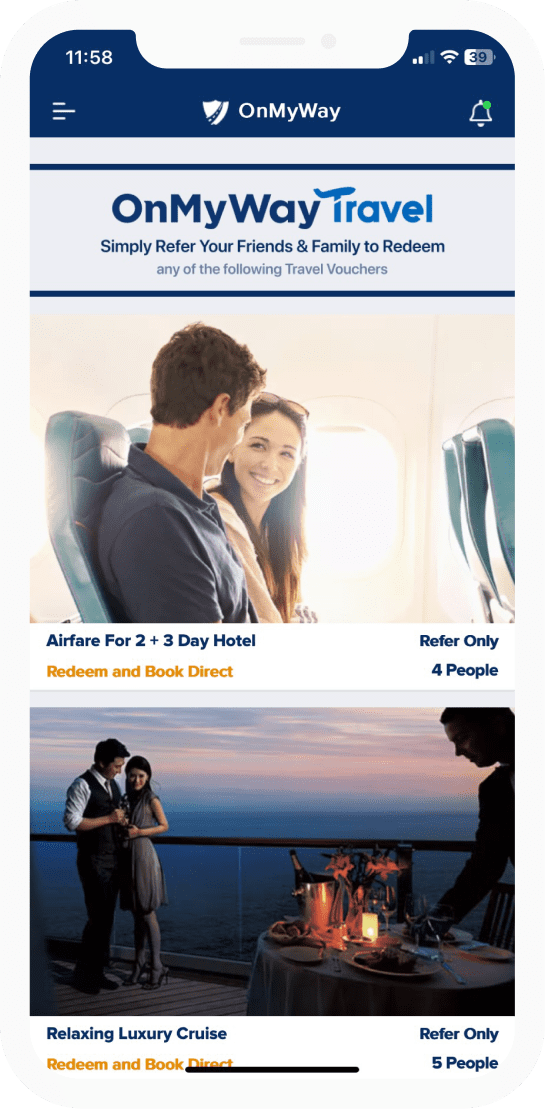

OnMyWay Is The #1 Distracted Driving Mobile App In The Nation!

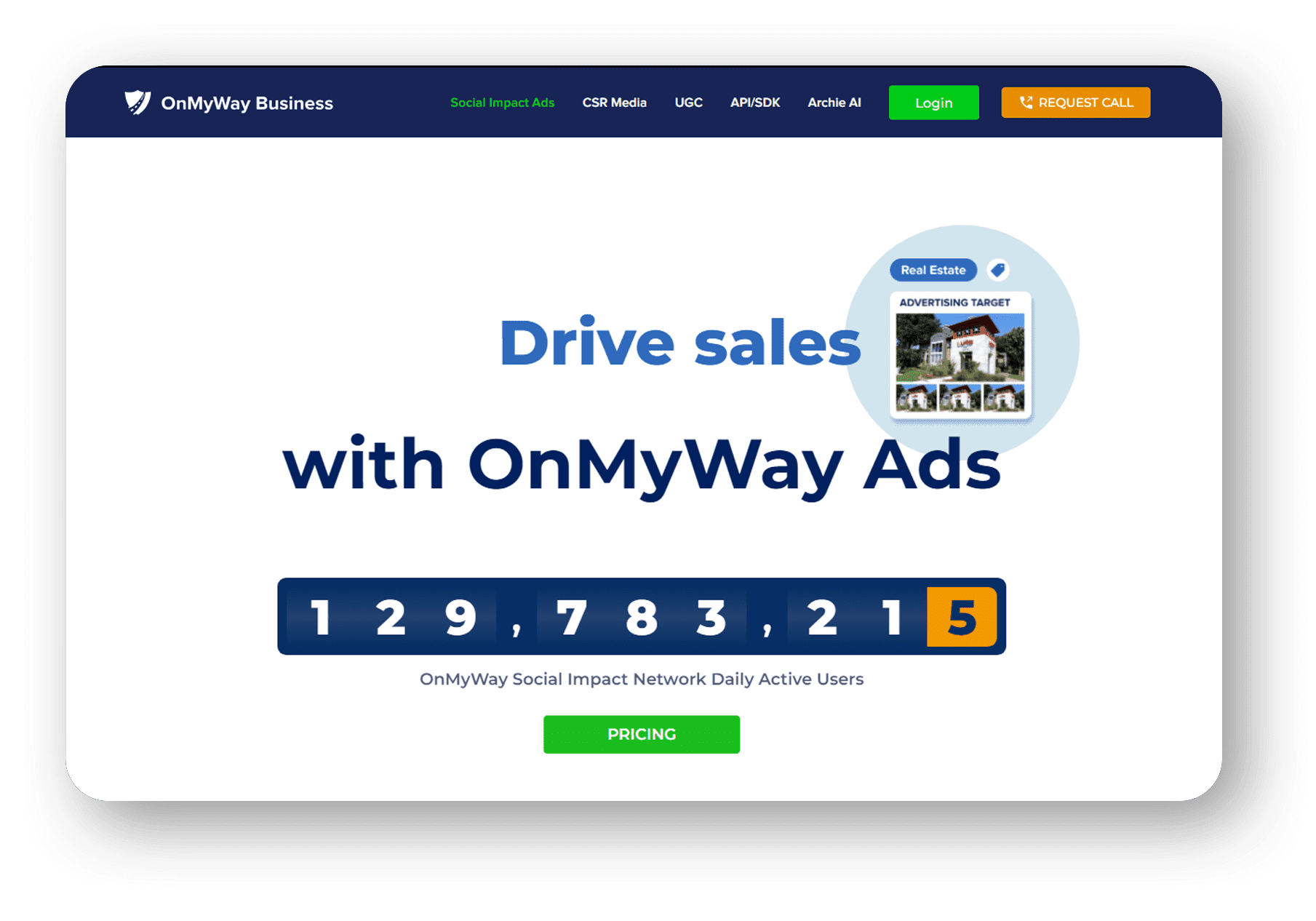

OnMyWay, based in Charleston, SC, The Only Mobile App That Pays its Users Not to Text and Drive.

The #1 cause of death among young adults ages 16-27 is Car Accidents, with the majority related to Distracted Driving.

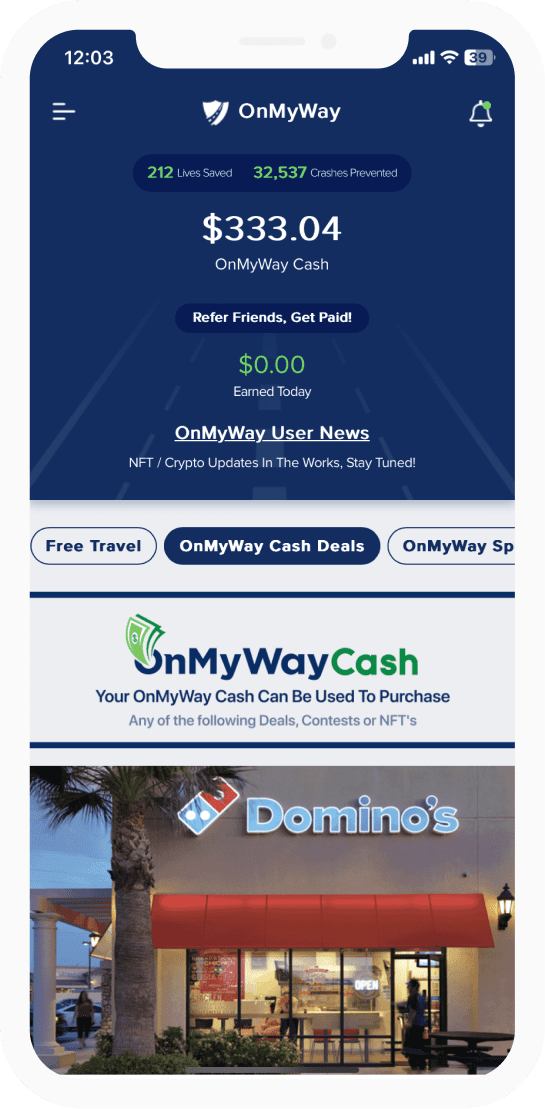

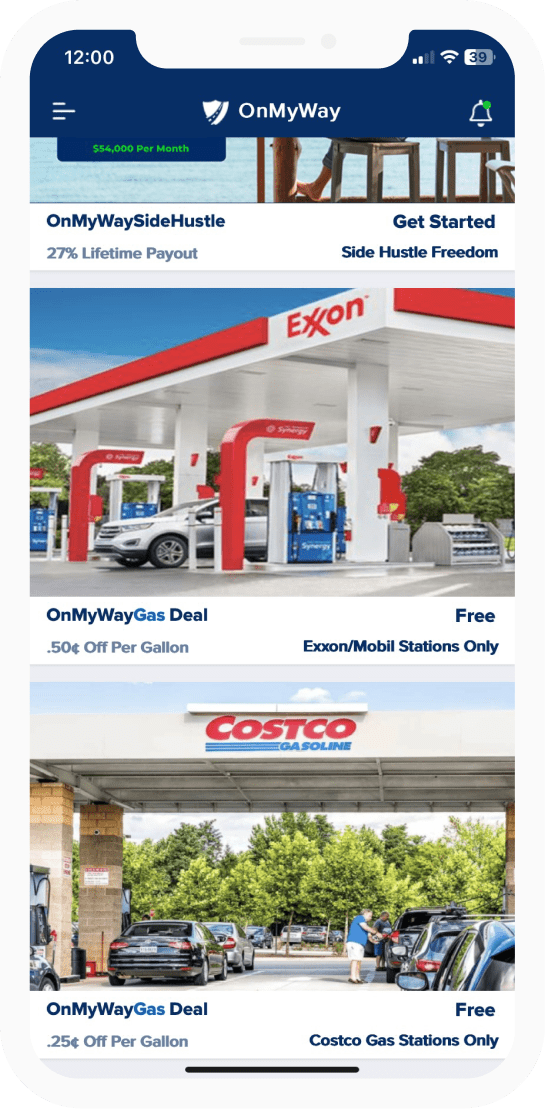

OnMyWay’s mission is to reverse this epidemic through positive rewards. Users get paid for every mile they do not text and drive and can refer their friends to get compensated for them as well.

The money earned can then be used for Cash Cards, Gift Cards, Travel Deals and Much, Much More….

The company also makes it a point to let users know that OnMyWay does NOT sell users data and only tracks them for purposes of providing a better experience while using the app.

The OnMyWay app is free to download and is currently available on both the App Store for iPhones and Google Play for Android @ OnMyWay; Drive Safe, Get Paid.

Download App Now – https://r.onmyway.com

Sponsors and advertisers can contact the company directly through their website @ www.onmyway.com